Last month I indicated that my “buying lights” were flashing, both yellow and green. In this issue, I am going to discuss how one might find some green light deals and bulk sale programs being proposed to clear large inventories of foreclosed homes.

You may wonder why as the writer of the Apartment Reporter, I am and have been focused on single family houses. It is simple. The housing market’s collapse has been a significant drag on our economy, both locally and nationally. In the past, the vultures (investors) have cleaned the carcasses (defaulted properties) by bringing in fresh capital along with the desire to profit from their purchases. With Fannie Mae, Freddie Mac, and large banks refusing to move the massive amount of foreclosed properties through the system at once for fear of quickly driving values through the floor, the train wreck which is our housing market has been moving slowly albeit the prices have fallen dramatically.

It appears through some recent press releases that both Fannie Mae and Freddie Mac will be selling pools of foreclosed homes to investors. As part of this “REO to Rental” pilot initiative, there will be an agreement with the purchaser that the home will be rented and not flipped immediately.

Two things will clearly occur if this program is implemented by the agencies along with large banks:

1. The glut of homes will be cleared which will essentially bring us to the bottom of the abyss.

2. There will be more rental opportunities for our residents.

As apartment owners, we can look at this situation and get frustrated that the agencies are by default creating competition for us through their mandate to hold the purchases as rentals. I see it in a more positive light, given that these new owners will create jobs as they fix up and manage their properties. While the pricing of homes may decline from their current levels, I’m confident that we’ll find a bottom as the foreclosure wave works its way through the system.

If you are interested in becoming a potential buyer of these homes, either one at a time or en masse, you can sign up for the Fannie Mae program by going to this link: http://www.homepath.com/structuredsales.html. As an apartment owner, you have a distinct advantage since you understand the importance of management and how to underwrite realistic income and expenses when evaluating the potential purchases.

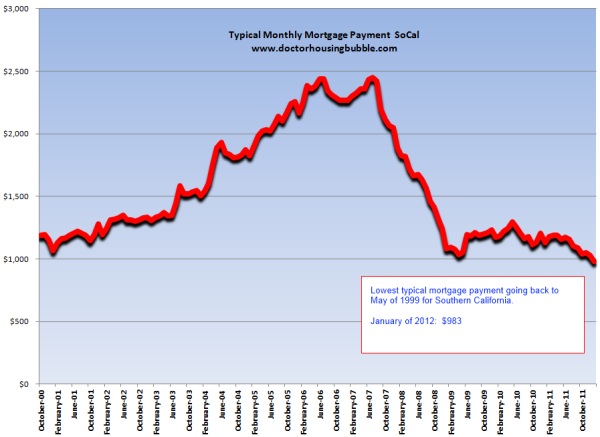

While I have criticized the Federal Reserve for pushing interest rates to nearly zero, punishing, thus, discouraging savers and encouraging investors to seek almost any yield above zero, the very big positive is that borrowers who qualified for mortgages have cut their payments massively. The average mortgage payment (for people who purchased a house in Southern California in January 2012) was $983. This is a 59% drop from the peak in 2007 of $2,447, as seen in Figure 1.

Source: www.doctorhousingbubble.com

Approximately one in every three purchases in California are closed using all cash (no mortgage) and about one in four are reported as non-owner occupied (investors). While I believe we will see more price declines in houses, clearly the vultures have gotten very active, which is a healthy sign. If you have a penchant for the distressed, then I encourage you to scout a market and see if there are any house deals that make economic sense to you.

Keep in mind, if the market is not close to home (i.e. YOU) or you don’t want to be engulfed in management, then find quality management (and likely maintenance) before you write your first offer. As an owner of apartments, you know how important this is to the success of your investment as well as your sanity.

I’m hopeful that the lenders will actually follow through with the proposed programs to sell foreclosed homes to investors. If they do, a giant drag on our economy will be removed.

Kyle Kazan

Chief Economist

Contrarianomics

www.contrarianomics.com