I’d like to start out this month’s report with some very positive news. For the first time in several years, a poll of my management company’s Southern California managers about the economy (“is it getting better, staying the same or getting worse”?), not one answered “getting worse”. About 2/3’s answered, “staying the same” while the remaining 1/3 said things were getting better. We are also hearing some positive reports from our team in the Pacific Northwest. Couple that with the opportunity that we’ve seen from our clients who are purchasing “value add” properties.

We have been able to fix up units and push rents. At a few of my properties where we had suffered some rent declines during the last few years, we have spent some money to upgrade our units and we’ve enjoyed higher rents than we got at the peak in 2007. This is anecdotal and not yet market-wide but remember in 1999 when many owners were simply happy to have fully occupied buildings and were timid in pushing the income? I’m seeing some similarities to those days.

I am making sure that my properties are appealing starting from the curb out front. Depending on the occupancy, I am taking a fresh look at the local rents and have been willing to go higher than the top rent comp in certain circumstances. It is rewarding to sometimes be the first one at the dance and I encourage you to take a fresh look at your property(ies) and if you see the same things that I am, try an upgrade on your next vacant.

The often forgotten key to success is motivating and convincing the on-site manager or on-site management team. If they have been managing your property through the downturn, you might find that they do not see the forest for the trees and for good reason. They have felt the pressure and will need to understand the plan and buy into it since they need to sell it to new residents.

In my opinion, the flood of artificially cheap money and expansion of the government balance sheet has buoyed the economy. In Figure 1, we see that interest rates are at historic lows and coupled with depressed house prices are making the purchase of a home much cheaper

Figure 1

Interest Rates on Fixed 30 Year Mortgages

Source: Mortgage Banker’s Association

In Figure 2, we see that the shadow inventory of short sales and foreclosures has decreased.

Figure 2

New Single Family Home Sales vs. Total Inventory

Source: Mortgage Banker’s Association, National Association of Realtors, Goldman Sachs Research

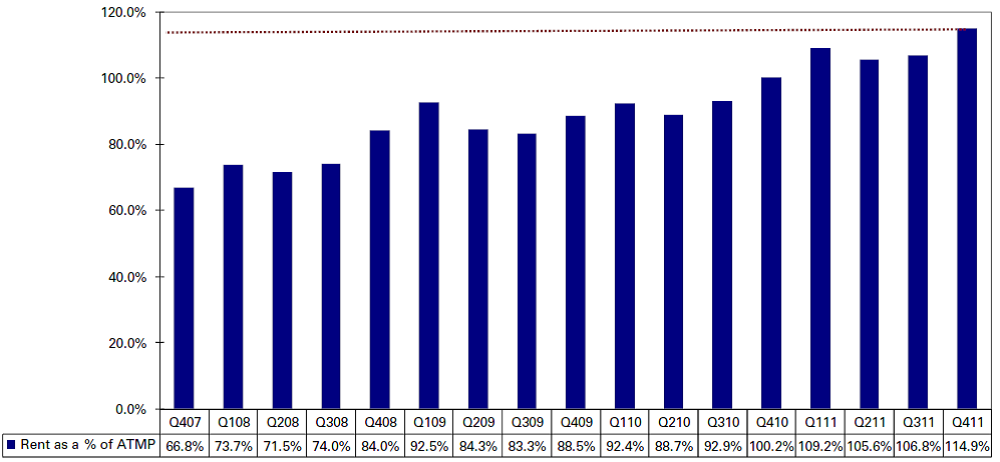

In Figure 3, we see that on average, mortgage payments are cheaper than rents.

Figure 3

Rent as a % of After Tax Mortgage Payments

Source: Deutsche Bank

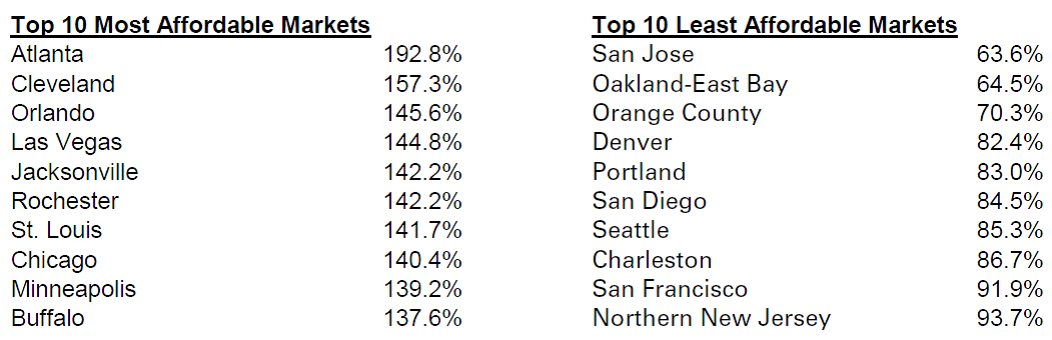

The charts and graphs are showing that mortgage payments in many areas around the country are cheaper than rent. Single family homes are now very near the bottom and are likely undervalued. In Figure 4, we see the most and least affordable markets in the US in comparing rent to mortgage payment. The most affordable markets should offer the best investor yield on house purchases while the least affordable should allow for rent increases since renting still offers good value in comparison to buying a home.

Figure 4

Most and Least Affordable US Markets as Measured by After Tax Mortgage Payment

Source: Deutsche Bank

In the most affordable markets, buying rental houses makes very good sense. I have launched a fund to do just that and enjoyed Warren Buffett’s recent remarks about the value of single family homes (“a very attractive asset class”) – http://www.youtube.com/watch?v=p1A5WKMHfp0&feature=player_embedded.

The tightening of the rental market, depressed prices of houses and very cheap financing while somewhat at odds with each other are providing unique opportunities. I am enjoying higher rents in some areas and vulture purchases in others. More to come as summer approaches!

Kyle Kazan

Chief Economist

Contrarianomics

www.contrarianomics.com