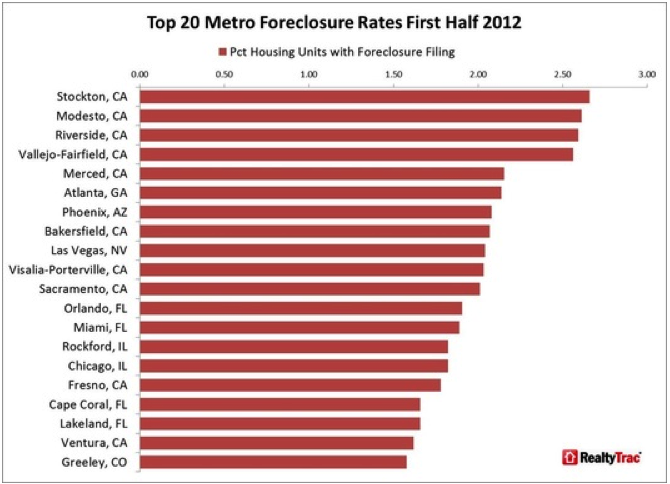

The real estate market and the general economy in the United States are about as difficult to read and predict as I can remember. For instance, in chart 1 we note that Las Vegas was 9th in the nation in percentage of houses with foreclosure filings for the first half of 2012.

On the surface, that is excellent news for the Las Vegas real estate market which has consistently had the dubious distinction of highest foreclosure rate over the last several years. How did Las Vegas drop from #1 to #9? When we dig deeper however, we note that Nevada Assembly Bill 284 took effect in October of last year and that same month foreclosure filings fell by 75% month over month. That begs the question of what is Assembly Bill 284? The law requires those foreclosing on a home to file an affidavit proving they have the right to bring the action (no robosigning) – and it increases civil and criminal penalties (makes it a felony for the person signing on the dotted line for the lender). While the lenders took a breather in October to get their arms around the provisions, in November a Clark County grand jury indicted two Southern California title officers on a combined 606 felony and misdemeanor counts.

My focus is not the merits or faults of the law as I’m only concerned with its effects. It is clear that foreclosure activity has been lowered because of the law and not from miraculous market conditions.

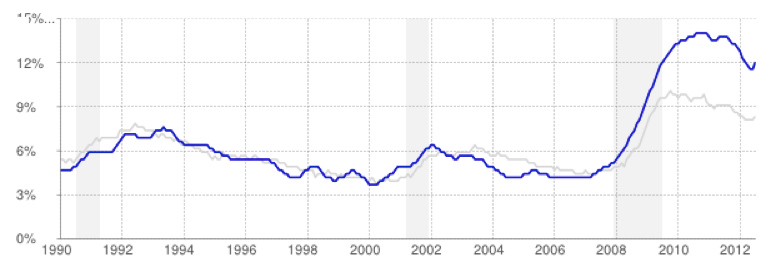

Interest rates are at (or near) historic lows which is a positive for home buyers yet the economy is barely keeping its head above water in almost every area of the country. While the unemployment rate started going down in 2011, recently it has been inching up in Nevada and nationally as seen in Chart 2.

Chart 2

Unemployment Rate: Nevada, National

Source: deptofnumbers.com

There are also large funds buying homes in big numbers around the country as rentals. I expect that in the very near future, there will be real estate investment trusts (REIT’s) that own only single family homes. This is a positive for house prices as inventory is being consumed for rentals (not a great thing for apartment owners).

As the inventory of foreclosed homes has gone down and pricing has moved up, one must wonder if housing has indeed bottomed. Analytics from RealtyTrac recently found that just 15% of REOs in Washington DC were for sale. Analytics firm CoreLogic estimated that just 10% of all REOs in the US were listed for sale.

Foreclosed home – Las Vegas, Nevada

As you can see, Adam Smith’s “invisible hand of the market” is being banged around quite a bit by forces other than simple supply and demand. I believe our very slow economy will continue muddling along for some time with the Fed throwing everything it has left to spur growth. This means low interest rates (money printing) for the foreseeable future. At some point however, the US will have a nasty bout of inflation (timing is always the most difficult to predict). In short, I don’t feel a rush to buy en masse but by finding those needles mixed into the haystacks, long term ownership should bode well for investment.

I’m always looking and over the next few years, I’d like to exchange more green paper for income producing tangible assets (real estate). As a matter of fact, I’m sifting through a few distressed bales of hay right now to verify that I’m really looking at needles and not more straw.

Kyle Kazan

Chief Economist

Contrarianomics