I am asked on a daily basis where I see opportunity to make money. Even from people who have made vast fortunes investing in real estate. Too often I hear many of those same investors say that the day to make millions in buying property has passed us forever.

At the same time, I come into contact with the “hungry to make it” investors. Typically young and without a lot of experience who dream of owning successful properties. Their vision is that the time is now and someday they will experience the dream of my wealthy investor friends.

![hindsight[1]](http://www.contrarianomics.com/wp-content/uploads/2014/09/hindsight1.png)

Since the only time we are guaranteed is right now, I do my very best to stay away from the hindsight mirror. Yes, the one which reminds me of all of the amazing deals I passed on and also validates my housing crash prediction. While good for brief reminiscence, that rearview mirror can clutter the mind as one looks at the 30 days in September 2014 with the freshness they deserve.

The difference between those who have enjoyed success and those who are just staking their claim is fear or put in a nice way, differing risk profile. When I look back on my own career, I remember the feeling of having nothing and therefore having nothing to lose. Ignorance was truly bliss as I didn’t have the experience for proper analysis and thusly there was no paralysis. While I am immensely proud of my education from the University of Southern California, my diploma was not a precursor to my success in investing. It was my lack of fear to invest my money when the vast majority felt real estate was not a smart buy that set the course for my career as a real estate investor and manager.

If I created a Venn diagram where characteristics of the most successful people I know were charted, several qualities would be common. They are: courage (ability to rise above the fear of failure), an ability to block out the noise, an independent streak and most importantly a commitment to succeeding no matter the obstacle (and there are always many).

The curse of success is how it affects the ego. The natural feeling is pride which conflicts with the freedom to fail. In other words, I don’t want to lose the prestige I’ve attained. Quite frankly, this is something I battle because who doesn’t enjoy being asked to be a keynote speaker by industry peers and who doesn’t want to be quoted in the newspaper and respected as a success? All of that said, I enjoy the feeling I had during my first investments when I told my girlfriend (now wife) that I feel like the “fool on the hill.”

In fact, I recommend going to www.youtube.com and typing in “Beatles and Fool on the Hill.” Even if this isn’t the genre of music you enjoy, if you can see yourself with the independent thinking of the person sitting alone on the hill, it should offer a different perspective on life. This reminds me that the invitations and other ego gratifications don’t matter and I bring myself back to seeing the world in a solitary and grounded lens.

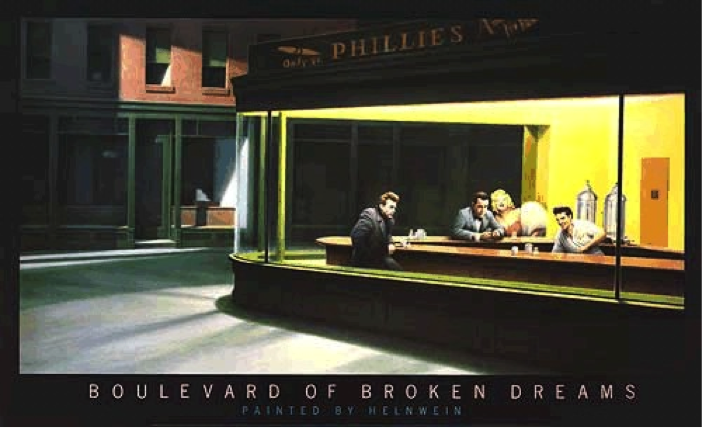

When I was in college, one of my 3 roommates hung a picture call the “Boulevard of Broken Dreams” on our apartment wall. Thinking it funny, we inserted photos of ourselves next to the celebrities depicted in the poster. It was during that year that I made a pact to myself that I would not let my dreams turn to regrets. I would take big risks.

While 20/20 hindsight in the years ahead will determine whether the investments of today were brilliant, acceptable or foolish, I can say that a new breed of investors will find a way to succeed right now. Before I ascend to my happy place alone on the hill, I will share that even the foolish investments have done brilliantly if held long enough. While there were major ups and downs in the 1970’s and 1980’s, I can’t think of any apartment buildings which were purchased during that 20 year span and are still owned today which are not home runs.

Kyle Kazan

Chief Economist

Contrarianomics

![OPPORTUNITY SURROUNDS US-05[1]](http://www.contrarianomics.com/wp-content/uploads/2014/09/OPPORTUNITY-SURROUNDS-US-051-1038x576.png)