If you are a longtime reader than you know that I love statistics. In fact, I like to close my door and review charts and graphs in a vacuum with absolutely no commentary to see what conclusions I come to on my own. As a fellow commercial real estate investor, I’m in search of the “road not taken”. As Robert Frost so aptly wrote, “that has made all the difference,” to which I happily share that my best purchases were made with little competition.

As an economist, I do my best to evaluate the trends, dig beneath the surface, understand history and human behavior to formulate a current conclusion as well as a likely scenario for the future. If it were easy than bankruptcy attorneys would be broke and we’d all be Warren Buffet.

In this issue of the Apartment Reporter, I’m going to let many graphs tell a story and share my interpretations.

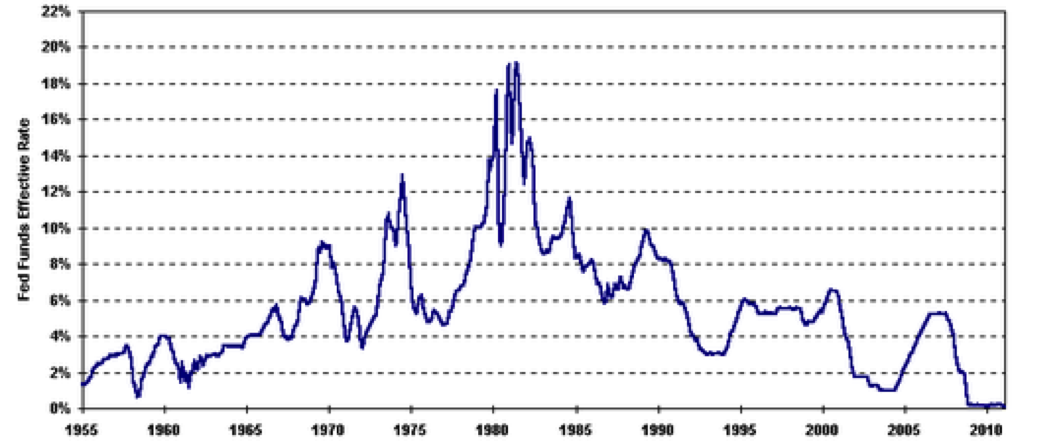

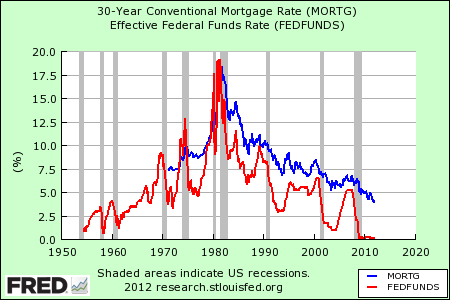

The Federal Reserve announced that it plans on keeping the Fed Funds Rate the same into 2014. In Figure 1, we see that the effective rate for the Fed Funds is at a historic low (from 1955 – 2012).

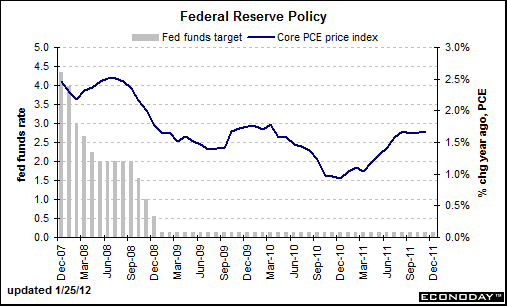

In Figure 2, we see the correlation between inflation and the Fed’s fund rate. Current Federal Reserve Chairman Bernanke is famously quoted as saying he would use a “helicopter drop” of money into the economy to fight deflation. Watching the Core PCE price index is a good indicator on inflation.

In Figure 3, we note that 30 year fixed rate mortgages which follow the Fed Funds rate have also dropped to historic lows.

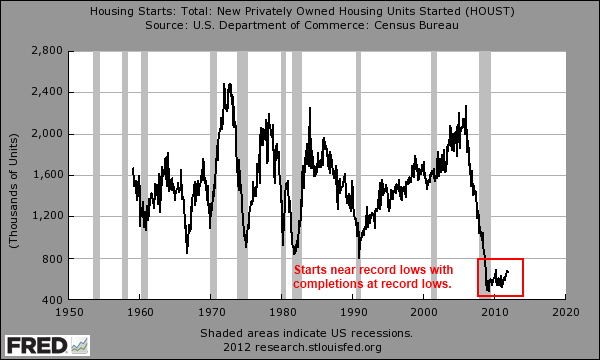

In Figure 4, we note that housing starts are also at a historic low.

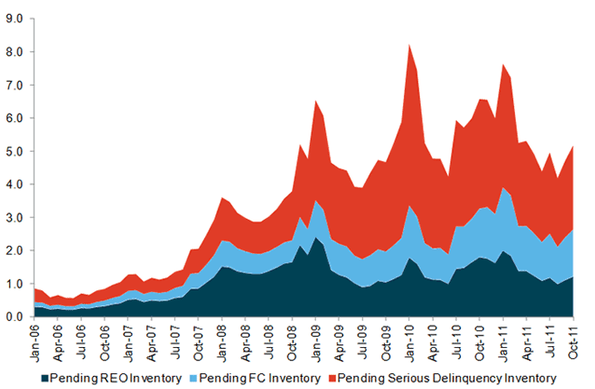

In Figure 5, we note that the shadow inventory of homes for sale (which includes REO’s and likely short sale listings) is far higher than the less than 1 month it was in 2006 (peak of the housing bubble).

Number of Months (Not Seasonally Adjusted)

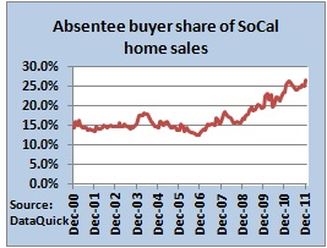

In Figure 6, we see that out of every 100 houses sold in California, more than 25 are purchased as non-owner occupied. This doesn’t count those that buy a house as a “2nd home” for the owner occupied financing but decide to rent it out instead.

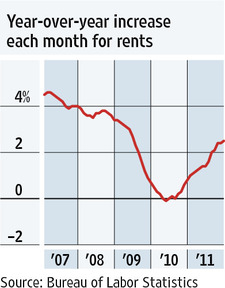

Lastly, in Figure 7, we note a favorite slide for all of us is that we are starting to see some rent inflation. This is a macro figure so it is quite possible that you may own in a location(s) which isn’t yet experience this growth.

My conclusion is that the Federal Reserve is seeing that the economy is struggling to gain traction.

AN OBSERVATION: My cousin and I recently dined in a packed Fleming’s Steakhouse in downtown Los Angeles before a sporting event and she said, “looks like no recession in here”. I have heard this comment many times in the last few years but as someone who manages over 5,000 units in 5 states, I will share that far more tenants are struggling to hang on than was the case in 2007.

The Fed is making clear that they will do everything they can to keep interest rates in the United States very low for the foreseeable future.

Even though mortgage rates are at historic lows, it isn’t enough to encourage people to purchase homes. I think this is due to the economy and also very tight loan regulations (which were non-existent during the boom) that blocks people with a foreclosure on their credit from this cheap financing. These requirements are also making more people renters

There is a massive oversupply of homes on the market and coming through distress. Home prices are now below replacement cost which has sidelined the builders for the foreseeable future. The distressed housing market is also creating more and more renters which is starting to push rents.

With that yellow light blinking in the background, I have told some friends and family that buying a rental house right now makes sense (pricing and rental market specific). I bought a house late last year and am yielding over 10% on a cash on cash basis. I am planning on rolling out a fund to buy many more so I see a green light.

For those who are savers and need yield on their money, I like this investment. Especially if one can take advantage and lock in at these very low interest rates (I could not and bought all cash. It still worked for me).

If you share the same conclusion from the story the 7 graphs told then Happy Hunting! If not, I don’t think believe there is a rush as we likely have years of a tough economy ahead.

Kyle Kazan

Chief Economist

Contrarianomics

www.contrarianomics.com