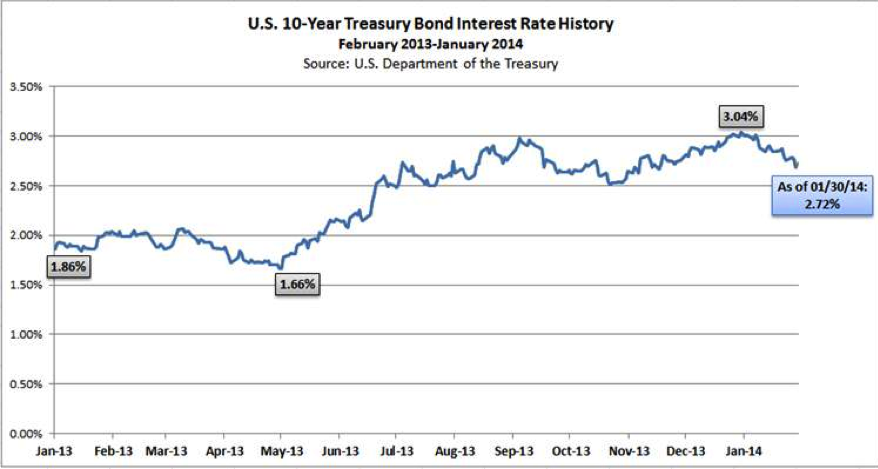

As we start to get rolling in our new year and the President of the United States has given the State of the Union, I want to share my State of the Real Estate Market. Over the last couple of years, Capitalization Rates (Cap Rates) on apartments around the US have dropped and this includes the last 12 months when at the same time, rates on the 10 year Treasury have risen. We can see in Figure 1 that the bottom was in May and the high was in December. From peak to trough, in 8 months, the rates went up 138 basis points.

Figure 1

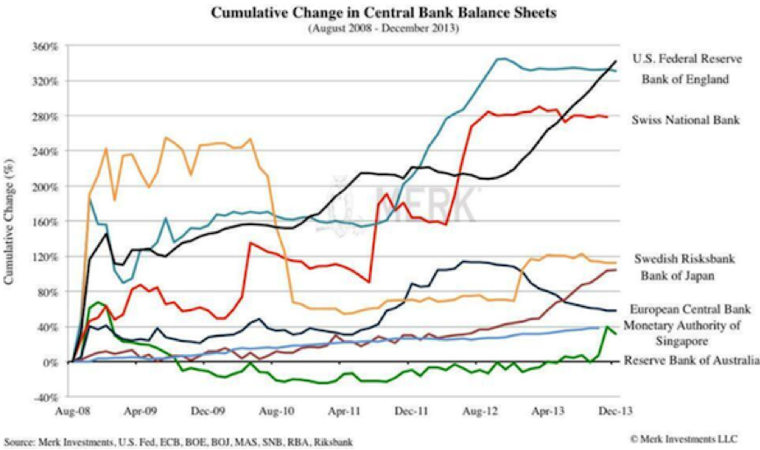

While rates were rising, the Federal Reserve was increasing its holdings of US Treasuries. The Fed Chairman Ben Bernanke has indicated that Quantatative Easing will be tapering once certain benchmarks are reached and one would believe that those policies will continue under the soon to be Fed Chairperson, Janet Yellen. In Figure 2, it is clear that while the US is not alone in expanding its balance sheet, its pace of late is the fastest.

Figure 2

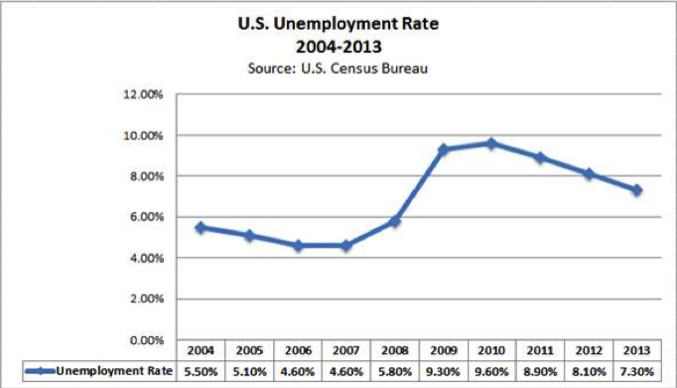

The Fed has indicated that for tapering its bond purchases (or money printing), it is focused on lowered unemployment and also a target of 2% annual inflation rate. Almost all of the pundits talk exclusively about unemployment while ignoring inflation. In Figure 3, we see the unemployment rate (the U3 from the BLS) has gone down for the last three years.

Figure 3

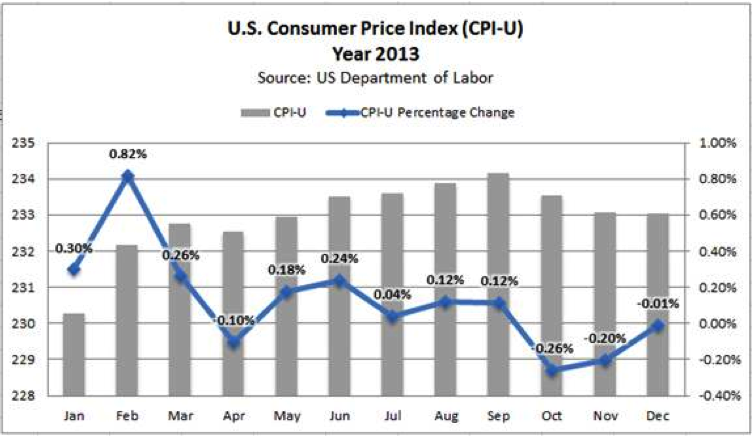

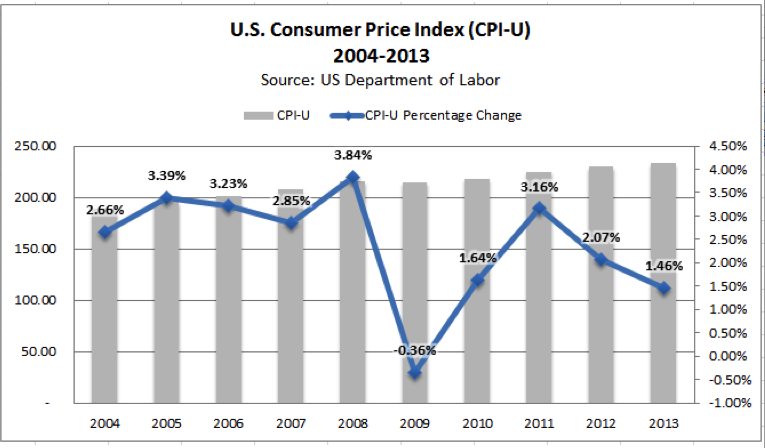

The other part of the Fed’s stated equation on ending Quantitative Easing can be seen in Figures 4 and 5. Clearly government measures of inflation doesn’t seem to be very strong and my bet is that while the Fed continues to give positive sound bites, it will not stop its purchasing in the foreseeable future. Remember that the rates went up when there was only a discussion of slowing the bond purchases even though they didn’t actually taper.

Figure 4

Figure 5

Generally speaking as someone who operates many thousands of apartments around the United States, it feels like the economy is doing alright. Not as strong as the bubble years but stronger than 2008 – 2010. In Southern California, most buildings have few vacancies if any. With Cap Rates teetering around the level of the borrowing rates, we are in bubble territory again unless one believes that rents will be rising faster than expenses and interest rates.

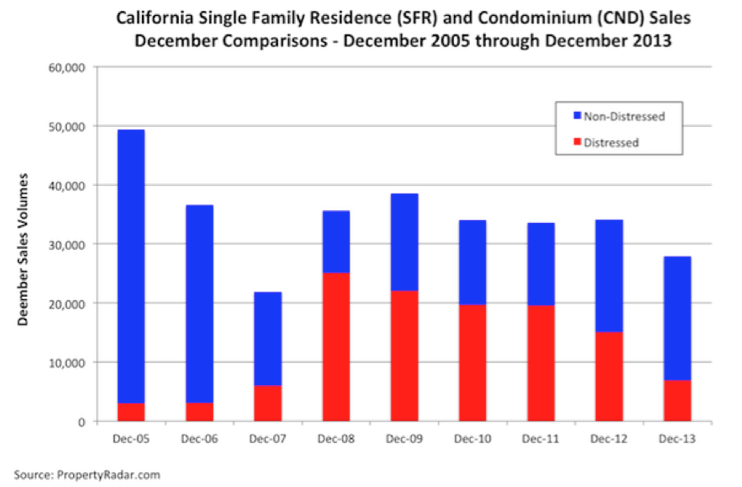

Remembering that I have stayed out of financial trouble through my investing career by not gambling on greater fools buying from me so that I can flip for a quick profit, I am focused on cash flow and hopeful upside potential. Distressed properties are disappearing and an example is Figure 6 showing home sales in California which was one of the worst five markets in the US after the bubble popped.

Figure 6

My biggest concerns revolve around a potential economic shock which hampers occupancy and/or collections. Most purchasers don’t factor a down market into their numbers. The other concern is stagflation which would mean higher interest rates without a rise in rents. While I don’t think this is likely, I could see several scenarios where it could occur. Remember, it is always healthy to picture the rainy day and how you would react if such a situation happens.

I am currently looking for opportunities to purchase in three states and of course will not buy if there is negative leverage in the pricing. For downside protection, I am putting more money down on my deals and taking on less debt. While this might well lower my future Internal Rates of Return, it is my insurance policy just in case a nasty scenario plays out.