Last month I discussed whether we are in the late innings of the current apartment recovery/boom. This month, I’m going to share some thoughts on data swings away from homeownership and towards renting.

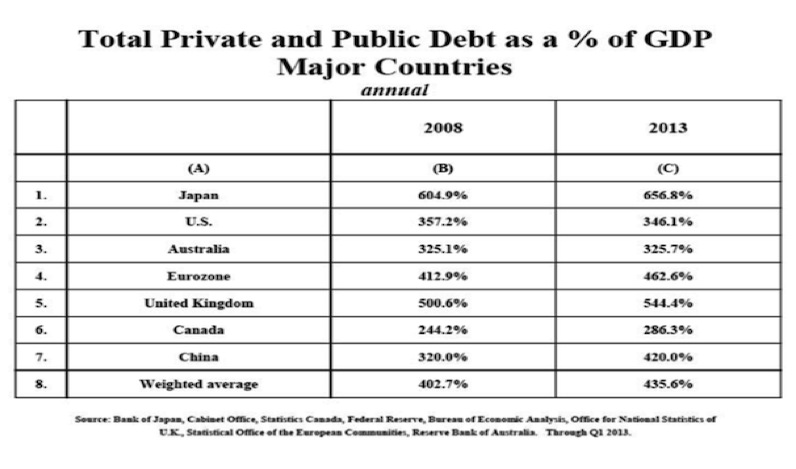

Since the Great Recession, total debt to GDP has increased by nearly 35% across the major economies. The biggest borrowers are Japan, the Eurozone and China. The graph in Figure 1 supports my theory that bank balance sheets were simply moved from investors to taxpayers. I was surprised that the US’s share debt to GDP has shrunk given the rise in deficits and Quantitative Easing measures.

Figure 1

Source: Mauldin Economics / Hoisington Management

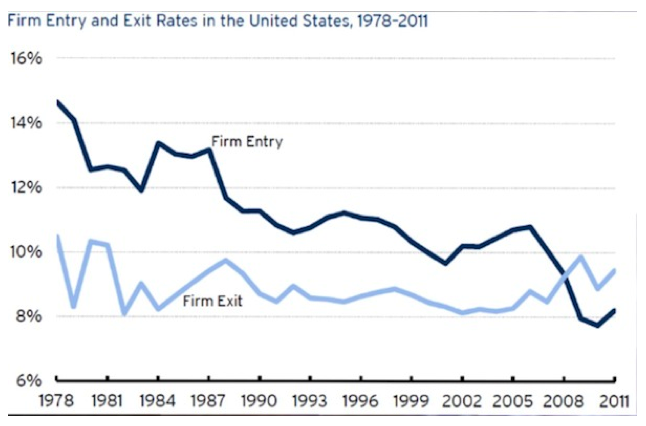

In any case, the government debt loads have increased substantially which will be a burden on businesses and taxpayers going forward. In the United States, we are seeing a net loss of businesses. In Figure 2, you can see the trend over 33 years (ending in 2011). As a business owner since 1993, I’ve seen the environment (particularly in California where I’ve resided my entire life; I have done business in many states and in 2 other countries) continually become more onerous.

Figure 2

Source: Mauldin Economics

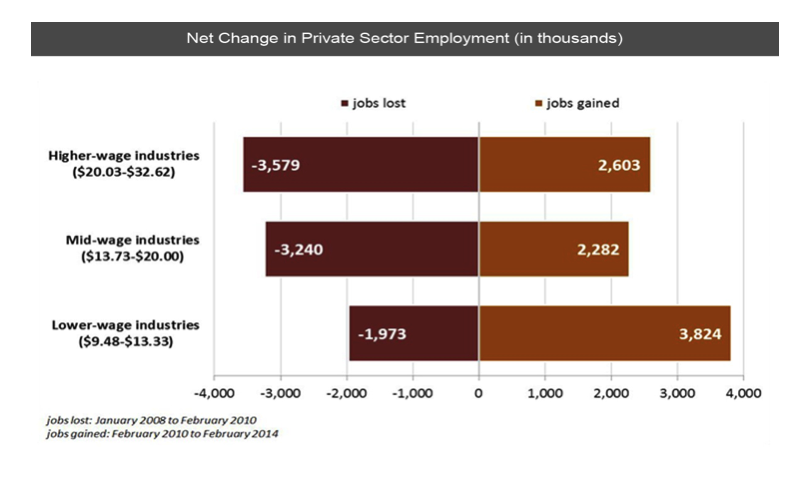

In Figure 3, we have had an uneven recovery. While the low wage earning jobs have more than fully recovered, mid and high wage earning jobs have not come back nearly as quickly.

Figure 3

Source: www.nelp.org/lowwagerecovery2014

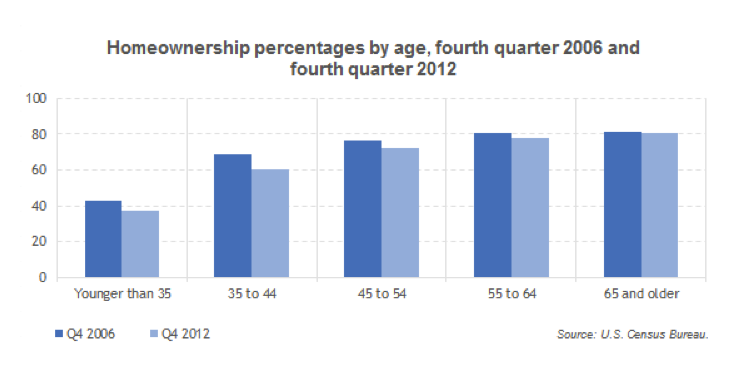

So how has this effected real estate? The housing market’s recovery is owed to investors who have been the largest buyer of homes since the recession started. New Real Estate Investment Trusts were formed to turn those purchases into rentals. In Figure 4, we see that the young is less likely to own a home now than in the past.

Figure 4

I have read a number of articles wherein the description of Millennials (born between the early 1980’s – early 2000’s depending on the source) are a group of people who care less about ownership. They will favor renting everything from bicycles and cars to computers and housing. As someone who employs many millennials, I have seen a mastery and comfort of technology along with technological change. I haven’t heard of a desire to own any less but have noticed this younger generation has come out of the starting gates strapped with debt.

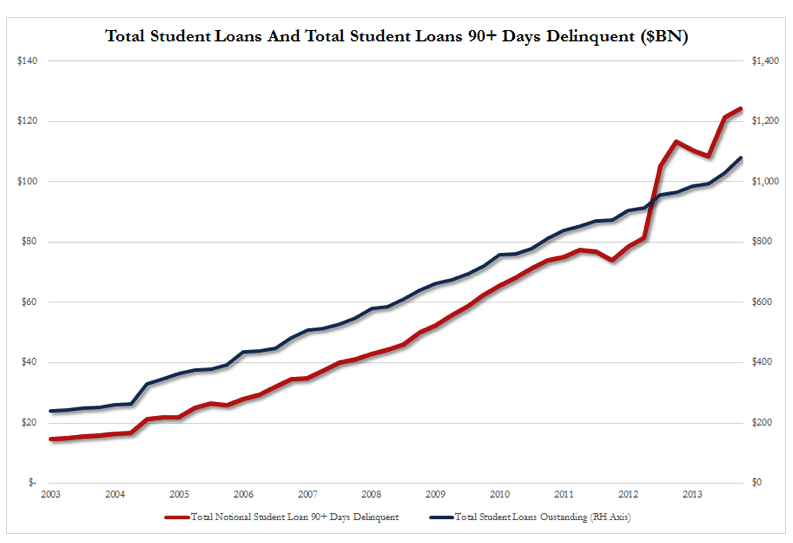

In Figure 5, we see the rise in student loans (along with defaults) over a 10 year period. I would argue that the reason for the low ownership in Figure 4 is due to fewer high paying jobs in Figure 3 and higher debt in Figure 5. Furthermore, the world debt to GDP levels and fewer business starts portend economies which push businesses and taxpayers evermore towards less take-home income.

Figure 5

As we are a nation of immigrants and new arrivals to our country rent on average for over 10 years coupled with our youngest generation of adult Americans who are saddled with loans, I feel comfortable that rental housing will be a strong business for many years to come. As apartment owners, the data showing a growing market of tenants is certainly in our favor.