One of the smartest decisions I’ve ever made was to purchase investment property. First it was houses and then I added apartments to my portfolio. Key to being successful has been management. Whether it is through my management company or local groups with whom I contract internationally or out of state, quality oversight of the properties is a must.

I have discussed focus on maximizing income and also ways to decrease expenses. Today I want to share some legal land mines that you need to avoid. As I do not know the nuances of eviction laws in every state, one such danger applies to California but may also be a threat in other states.

Keep your units habitable

While it goes without saying that every one of your occupied apartment units needs to always be in habitable condition, after many years of buying and managing buildings, I will offer the reminder just in case. A rough definition of habitable includes a leak-free, pest free dwelling with heat, lockable doors and windows along with paint and flooring in at least fair condition. To be clear, this is the absolute minimum and hopefully your units are far above this hard deck level.

There are different ways to measure ROI (return on investment or invested capital) which makes for an equation to either upgrade your units to charge higher rents or keep them clean and forgo asking the top of the market rents. In the ROI analysis, one should include the risk of an expensive and time consuming lawsuit as a potential downside.

Be careful who and how you hire work for your property

When someone is hired to work on your property either independently or through a company, it is vital to make sure that they are covered by worker’s compensation insurance and liability insurance. I have seen countless landlords save money by hiring a person standing outside of Home Depot and putting them to work at their property. On the face of it, there can be a large savings since paying cash doesn’t require insurance payments, tax withholding and other costs. Depending on the state, that person might be considered your employee and thusly is entitled to certain rights under the law. Should a legal squabble occur, there are states which make recovery of legal fees quite easy should they be able to prove even a small portion of their case.

Be prepared when evicting a resident

The legal scourge to landlords in California right now are lawyers who troll the hallways of the courthouses looking for tenants being evicted. They encourage the residents to demand a jury trial which is currently their right under the law. These lawyers almost never visit the property or conduct due diligence as it is quite easy to check a box and claim habitability issues.

Typically these law firms then contact the landlord and demand many thousands of dollars (we’ve had as much as $10,000 demanded in a single case) to settle the eviction. To be clear, a resident may be 3 months behind in rent and you are simply trying to gain possession of your unit and the tenant’s counsel will tell you to either pay them a large nuisance fee to go away or risk spending (and potentially losing) that amount or more to fight them off. These groups are using the system as a tool to extort money from you.

For landlords (usually self-managed properties) who aren’t focused and haven’t kept their units in good working order, these lawyers will contact ALL OF YOUR RESIDENTS and encourage them to pay them and not you. I have seen lawsuits brought against the building owner at the same time that their rents are not going to them. Sadly, some landlords without deep pockets have lost their properties in these actions.

The best way to be prepared is to actively manage your property. I have some simple tools:

1. Inspect the interior of every unit you own at least one time per year.

a. Document the inspection, including getting a signature from the resident(s) that any and all issues have been repaired.

2. Respond quickly to any and all resident complaints/requests.

3. When a resident is behind on the rent and you are considering an eviction, offer cash for keys. If I can spend less in paying the tenant than I would our lawyer and I can get possession (and re-rent) my apartment in a few weeks, it will save a lot of time, money and aggravation.

a. As mentioned before, it also gives me finality and takes away the risk of dealing with one of these predatory lawyers.

Should you be prepared for that lawsuit and it actually comes, we have encouraged our clients to fight and not give in to the extortion. We have been so ready for the fight that the predatory lawyers have asked to settle for $0 on the courthouse steps. Lastly, we have never agreed to seal the eviction from public record which is now a common request. We want the next potential landlord to know what happened before they make the decision to rent to this person.

If you have the mindset to prepare for a legal attack prior to the battle and take actions to mitigate the chances of a loss, you are prepared to win.

Kyle Kazan

Chief Economist

Contrarianomics

![OPPORTUNITY SURROUNDS US-05[1]](http://www.contrarianomics.com/wp-content/uploads/2014/09/OPPORTUNITY-SURROUNDS-US-051-1038x576.png)

![hindsight[1]](http://www.contrarianomics.com/wp-content/uploads/2014/09/hindsight1.png)

![PARTY LIKE IT'S 2005-05[1]](http://www.contrarianomics.com/wp-content/uploads/2014/08/PARTY-LIKE-ITS-2005-051-1038x576.png)

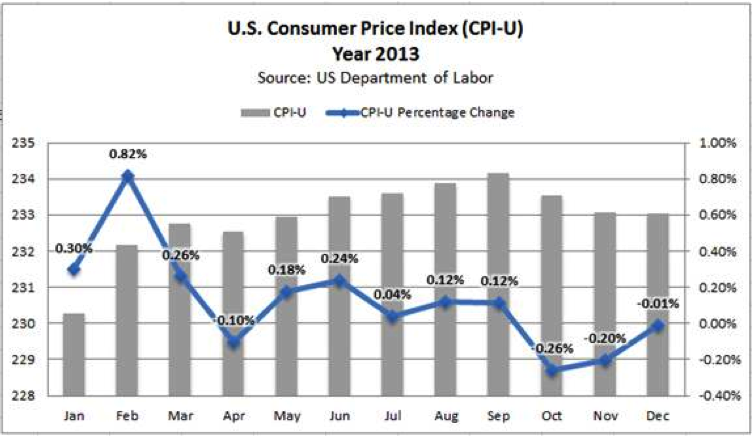

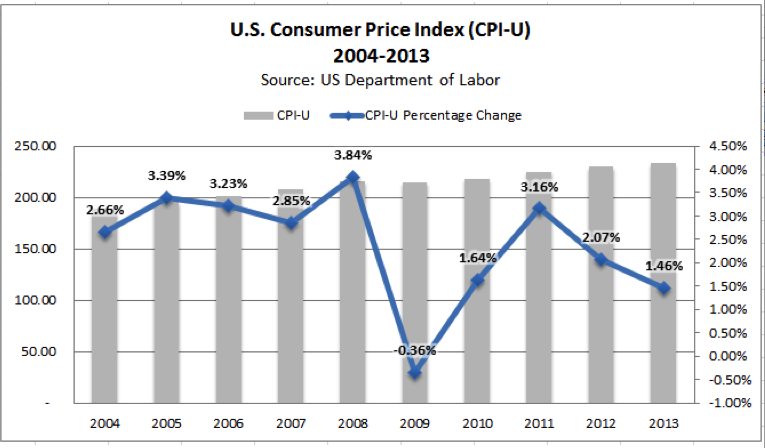

The Hershey Bar Test: Do you remember what a Hershey Bar cost you when you were a kid? Do you believe the price will continue to rise over the long term?

The Hershey Bar Test: Do you remember what a Hershey Bar cost you when you were a kid? Do you believe the price will continue to rise over the long term?