Recently, I was at a deli in New York City which accepted “cash only” so I paid for my meal with greenback dollars. Over the last several years, other than handing out tips, I simply use my credit cards and avoid hard currency. When the cashier handed the change to me, I was stunned at how lite and “tinny” the quarter felt. It reminded me of my travels around the globe and the quick judgment I made about the financial stability of the country based on how solid their currency felt in my hand.

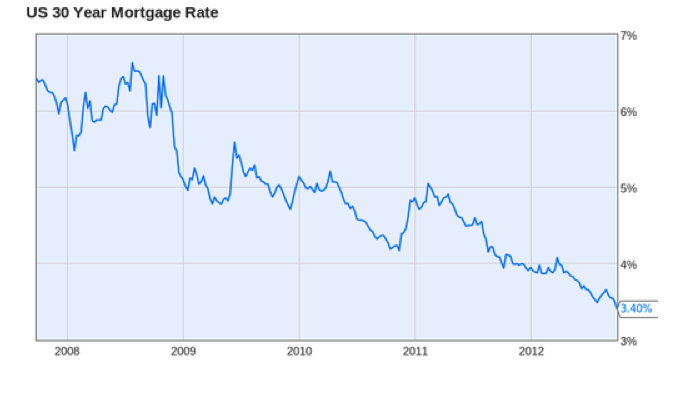

In September, Ben Bernanke announced the Federal Reserve’s third attempt to stimulate the economy through QE3 (3rd round of Quantative Easing) with the goal of lowering interest rates, particularly on home mortgage rates. I certainly enjoy the benefit of lowering my home mortgage along with some of my smaller properties (1-4 Units). As Warren Buffet said in an interview this year with CNBC when describing why he would load up on single family homes, “it’s a way in effect to short the dollar because you can take a 30 year mortgage and if it turns out your interest rate is too high, next week you refinance lower and if turns out it is too low the other guy is stuck with it for 30 years.”

Figure 1

Source: Los Angeles Times

Source: Los Angeles Times

What do my observations of the quarter in my hand and QE3 have in common? It has been (and remains) my belief and prediction that the Federal Reserve through quantitative easing is inflating our currency. As an aside, I am not passing judgment on Mr. Bernanke’s decision and am only sharing my predictions as an economist and investor for the likely result of these policies.

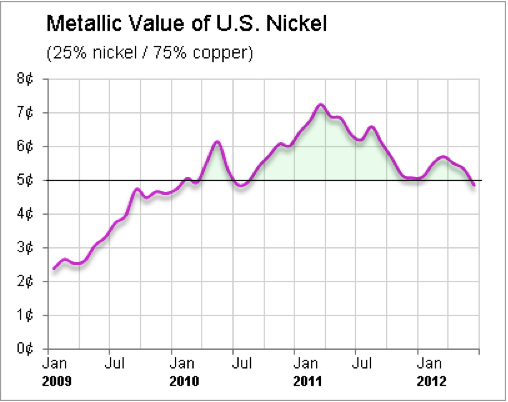

The nickel on the other hand has put the US in a bit of a conundrum. For the better part of the last 3 years, the commodity prices of the 1.25 grams of nickel and 3.75 grams of copper in each nickel added up to 6 or even 7 cents. As the value of our money falls against tangible assets (in this case commodities), the US government is going to have to lessen the value of the contents of its coins.

Figure 2

Source: seekingalpha.com

With this in mind, Congress passed the Coin Modernization, Oversight and Continuity Act of 2010. This will allow our government to get ahead of a bad metals trade. While this isn’t new (the content of the quarter dollar changed from 90% silver in 1964 to 75% Copper / 25%Nickel in 1965), I expect more changes ahead as a consequence of the Quantitative Easing.

How does this affect apartments (the asset class which I choose to invest most of my money)? First, it will become more expensive to build competing properties so the value of an existing portfolio should go up. In many cities around the US, houses can be purchased at far below replacement cost and when rented will enjoy a nice yield. If you can get a 30 year fixed rate loan on this investment, I would heed Mr. Buffett’s advice. Since the government is exploring cheaper ways to make the currency, I recommend looking for the right real estate investments for which to trade your green paper and whatever coin is produced.