As I look for my next distressed opportunity, I want to call attention to some data points for consideration. Remembering that I’ve purchased real estate on three continents, I am always scouring the globe for interesting situations for investment.

A large city is facing $20 billion in debt and unfunded liabilities. That breaks down to more than $25,000 per resident.

Back in 1960, the city actually had the highest per-capita income in the entire nation.

In 1950, there were about 296,000 manufacturing jobs. Today, there are less than 27,000.

There are lots of houses available for sale right now for $500 or less.

At this point, there are approximately 78,000 abandoned homes in the city.

About 1/3 of the city’s 140 square miles is either vacant or derelict.

An astounding 47% of the residents of the city are functionally illiterate.

Less than half of the residents over the age of 16 are working at this point.

60% of all children in the city are living in poverty.

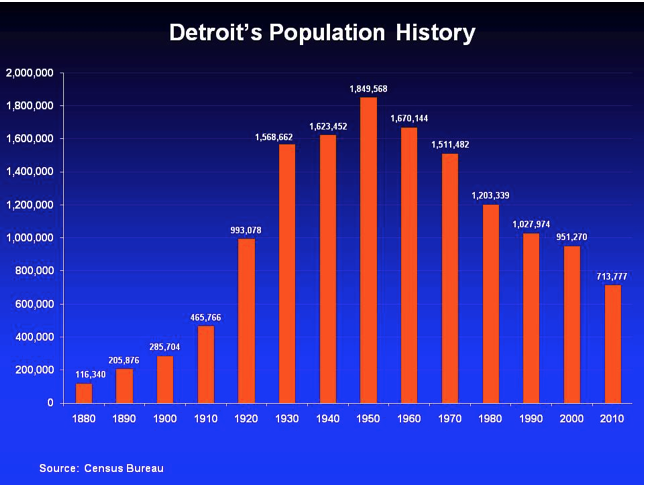

It was once the fourth-largest city in its nation, but over the past 60 years the population has fallen by 63%.

There are 70 “Superfund” hazardous waste sites.

40% of the street lights do not work.

Only 1/3 of the ambulances are running.

Some ambulances in the city have been used for so long that they have driven more than 250,000 miles.

2/3 of the parks in the city have been permanently closed down since 2008.

The size of the police force has been cut 40% over the past decade.

When you call the police, it takes them an average of 58 minutes to respond.

Due to budget cutbacks, most police stations are now closed to the public for 16 hours per day.

The violent crime rate is 5x higher than the national average.

The murder rate is 11x higher than it is in New York City.

Today, police solve less than 10% of the crimes that are committed.

So where is this city? India, China, perhaps sub-Saharan Africa? If I said Japan, Western Europe or the US, you would immediately dismiss that notion, right? The city is Detroit and listed are the current state of affairs.

I haven’t railed against poor governmental fiscal management / deficits in some time and those subjects have largely been out of the media since there are royals having babies, celebrities behaving badly and Congress has other tasks to not tackle first. Seemingly out of nowhere, the 18th largest city in the United States can no longer pay its bills and declared bankruptcy. While Detroit has some extreme issues which caused the population to decline, the fundamental rise in unfunded liabilities is all too common. More cities and states will someday have to reckon with this issue as will the United States.

As a former school teacher and police officer, at one time I too was excited by the promise of a pension from retirement to the grave. The police pension was particularly enticing since my salary was almost double what I was paid as an educator with more incentive bonuses to count towards the starting amount of my retirement payments. Clearly law enforcement negotiators were more successful than their counterparts were for teachers. Quite frankly, I felt that I was paid fairly during my time in a patrol car and thought a retirement valued at over $100,000 per year starting in my early 50’s was too good to be true. As I ponder this today, I do not believe that these obligations to those tasked with public safety and education (including my brother and many friends) will be met.

While it is easy to dismiss Detroit as a municipality with politicians who overly rewarded their union donors and promised more than they would eventually be able to deliver, the human side of this situation is devastating. Promises of “financial security” will be broken and the trickle down to restaurants, movie theaters, clothing stores, car dealerships and yes, apartments will be felt strongly. As tax revenues declined, Detroit responded by raising taxes and cutting services.

One of the reasons I have only chosen to invest in “cities which have legs” (likely sustained population growth) is because a swelling tax base has a better chance of muscling through hiccups (or Detroit’s case a choke) and withstanding economic downturns. The real estate market in Las Vegas collapsed in 2008 but the city is coming around because the population is growing again.

While I target opportunities where I believe the market has fallen further than it should and is likely to rebound, Detroit is not yet on that list. Michigan has protected pensioners and bond holders in its state constitution. This has meant that the city had no leverage against the two biggest obligations, thus far (potentially). If the bankruptcy court slashes the pensions and bonds, it will set a new precedent. Municipalities, counties and states around the country are watching.

We too should be taking note of the fiscal health of the various governments where we are currently invested and are considering for investment. Does your city/state have legs???