“You don’t have to be bright to be wealthy as long as you choose to invest in real estate.” Yes, I have heard that quote and other disparaging remarks about how easy it is to become wealthy if you just buy and own properties. While I know many people who are indeed wealthy (most don’t consider themselves so) because of rental property ownership, I know more people who have had terrible experiences in property investment. In other words, if it was simple, everyone would have done it and everyone would be wealthy.

If I have one skill above all others which has helped me in life, it is that I enjoy listening and learning from people. My favorite stories are of failures as I have found that the most successful people have failed the most but kept going. Michael Jordan, arguably the world’s greatest basketball player said, “I’ve missed more than 9000 shots in my career. I’ve lost almost 300 games. 26 times, I’ve been trusted to take the game winning shot and missed. I’ve failed over and over and over again in my life. And that is why I succeed.”

Early on I figured that if I could learn from someone else’s mistake, I could learn invaluable lessons on the cheap. To this day, I enjoy sharing real estate and business war stories. Not surprisingly, I didn’t avoid every land mine just from listening and learning and have made my share of mistakes. Since many people were generous with their advice when I was starting out, I am always happy to share and still quick to close my mouth and listen as I never stop learning.

The 3 lessons I will be sharing come from my own experience along with things which I’ve learned from others.

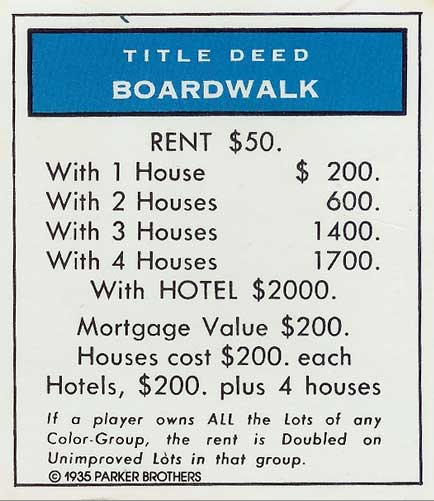

1. Buy the property right – You make your money on the buy! It is extremely rare that I don’t second guess myself when I’m under contract to purchase an apartment building. I think “buyer’s remorse” is natural and for me, I go back to my numbers which is why I decided to buy the property. I’ve done very well by staying within a tight box which allows for immediate positive cash flow. I budget for a rise in vacancies and conservative expenses just in case. I also conduct extensive due diligence to minimize surprise unbudgeted capital expenses. I have never purchased a building that I wasn’t prepared to own forever which allows me to not stress over it going up or down in value.

2. Operate / Manage correctly – I could write a book about all of the mistakes I’ve made in this area. When I bought my first properties, I wanted maintenance work done cheaply and rarely considered anything other than price. I did not concern myself with the risks I was taking because of hiring people who had no worker’s compensation and liability insurance. I even had managers working for me who were only compensated with free rent and without any employment agreement or tracking of hours worked. Much of this is “old school” management but it is financially dangerous. The worst stories I have heard and still hear involve “mom and pop” owners who manage the way I used to and get sued over wage and hour or worker’s compensation claims. It is always expensive as the owner will have to hire an attorney and inevitably pay the plaintiff and their lawyer. It is always smart to avert obvious risks before they teach a very expensive lesson.

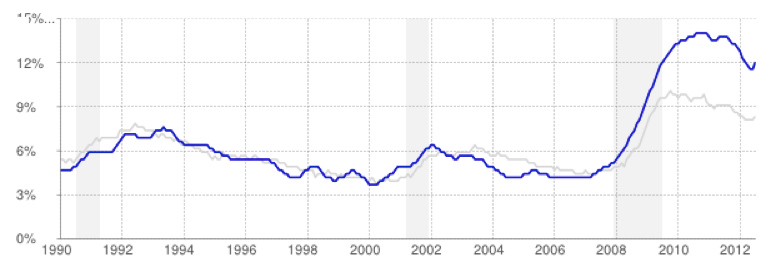

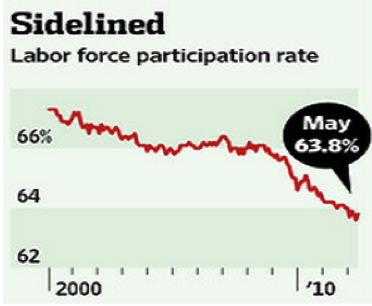

3. Staying power – I was told early on that to be a long-term survivor in real estate, one needed staying power. As real estate is cyclical and not a secular business and I’ve survived two economic downturns, I understand this lesson well. During the good times, I do not over-leverage my properties even though it is tempting to do so given that it could unlock equity and provide for my next down payment. As I do when I initially buy my properties, I run the numbers thoroughly when deciding how much (if any) cash to pull out from a refinance. It is very important to maintain apartments so that maintenance doesn’t get deferred for long. While there are many reasons for this, one is that it could be very costly if a roof needed replacement at the same time the building needed new plumbing and was suffering from an economic downturn. This could spell foreclosure as I have purchased properties that got hit by the perfect storm of poor planning by the previous owner who didn’t have the cash to pay for it all.

I’m confident that if you follow those three important lessons, you will be successful in your quest for successful apartment ownership and potentially great wealth!

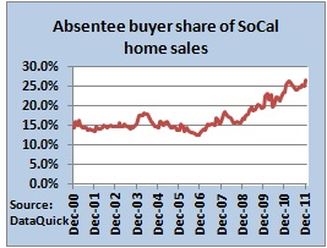

Source: Los Angeles Times

Source: Los Angeles Times

A trip hazard of over ½”

A trip hazard of over ½” Growth in a kitchen caused by a plumbing or roof leak above

Growth in a kitchen caused by a plumbing or roof leak above