In Septembers article, when I said, “the pressure cooker is heating up and something has to give,” something indeed gave; The Federal Reserve. The Fed unexpectedly left rates unchanged and made clear it would continue asset purchases thus causing the 10 year treasury yield to dramatically fall.

The recent squeeze of rising interest rates and lowered capitalization rates which I described should be a reminder or perhaps a warning that the interest rates are being manipulated. It showed that treasury investors and their expectations affected interest rates since the players in the market currently have confidence in the Fed’s ability to contain interest rates.

As countries in Europe have demonstrated over the last several years, confidence can disappear over the course of hours and interest rates can skyrocket immediately. While we real estate investors enjoy a portfolio of bricks and mortar and transactions which take 60 – 90 days after marketing the property for 30 – 60 days, that isn’t the case for bond investors. They buy and sell with via a key stroke of a computer and thusly the real estate world can be turned upside down abruptly.

The quandary which I struggle with is the Federal Reserve’s asset purchases (money printing) which has worked in lowering interest rates to record lows (we are off a bit from those lows as I write this article) and has pushed real estate prices down relative to their cap rates. With the rates artificially low then reciprocally the prices are artificially high. Since I believe that the price the United States will pay for this policy is inflation, does converting greenbacks today to hard assets make sense? My investment strategy says it does as long at 10 year financing is employed so that inflation has time to dig in once interest rates start to rise. In other words, I am willing to pay higher interest rates for a 10 year fixed rate instead of lowered payments for a 5 or 7 year fixed rate. Should rates stay low for 10 years then I will have paid for insurance that I didn’t need but I feel better with a longer runway before I have to refinance.

Further to my concerns is that the federal government is running a deficit approaching $17 Trillion and is benefitting from the artificially low interest rates along with the Federal Reserve’s purchasing of the debt. When confidence wanes or adjusts and interest rates rise, a sizable portion of the government budget will need to be allocated towards servicing the debt and at some point in our future, austerity will be ushered in or foisted upon us. Austerity (cuts in spending) usually brings about a drop in GDP and pain throughout the economy.

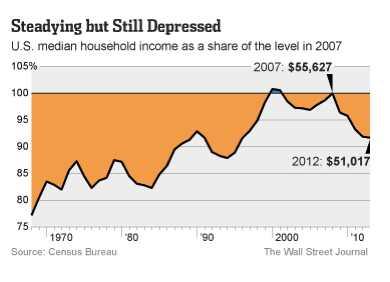

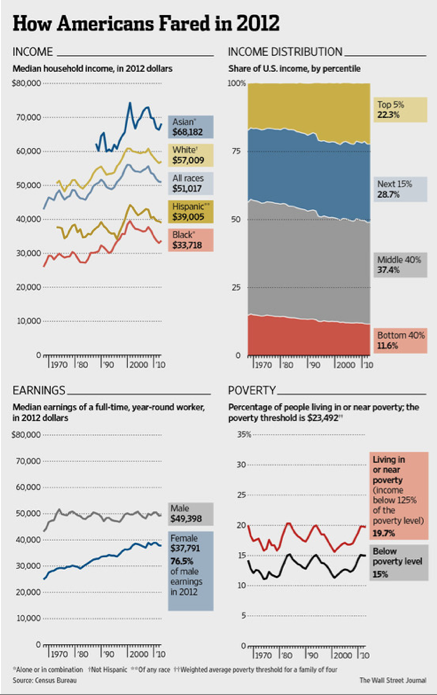

More immediate concerns are household income levels as that correlates directly on our ability to push rents. In other words, rising median household income is great for us as apartment owners. In Figures 1 and 2, we see that while median income isn’t rising, it isn’t falling either and appears to have leveled off.

Figure 1

Figure 2

I’m hopeful that this income stabilization is a prelude towards a rise past 2007 levels. Even though much of my concern is directed towards the actions of the Federal Reserve and our politicians in Washington DC who in my view have built a house of cards on debt/money printing, I am confident that the American people will weather the coming storm. Plus people need a place to live which is the main reason why I predominantly choose multi-family for investment even though it is the most management intensive of the asset classes.

I’ve noted that the recent rise and fall of interest rates has brought a new urgency to many sellers. I’m hopeful that I will be in escrow soon on a couple of deals which stalled because of the rise in rates but look more attractive given the recent fall.