“I have money to invest, please find me a deal now!” Those sentiments are echoed weekly if not daily by friends, clients, investors and family. My searching for the right property stretches across four states in which I’m targeting and includes 3 different asset classes. In other words, I have thrown a wide net out there to buy a deal.

Investors are paying up for properties and in the last couple of months, I have seen prices rise as bidding wars erupted. Last week, I was presented an opportunity to purchase a distressed apartment building through recapitalizing it with the lender.

I underwrote the deal including capital improvements to fix a flooding problem and to upgrade the interior of apartments. As has been my mode of operation since the early 1990’s, I use the highest current rents of comparable properties in the area and make that my high water mark for market rents at the subject building. While this pushed the income up in the underwriting, my valuation was below the bank’s by more than 10%.

When I shared my numbers, I was asked about rent raises over the next few years and I said that my crystal ball didn’t know. The lender told me that the other buyers are using between 4-6% annually for the next few years and that my price wouldn’t be competitive if I didn’t do the same.

To be more aggressive on pricing, there needs to be justification on how a decent return on investment will be made. Guesstimating proforma rents is exactly what was done during the bubble years. While we all may be able to guess correctly and have our proforma validated, there is also a chance that the rents will stay flat or go negative. In other words, it is simply a guess.

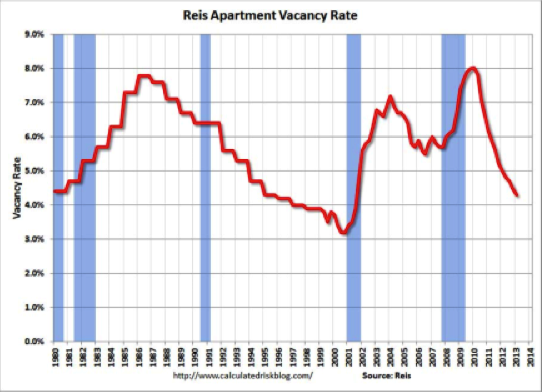

Rents are tied to occupancy and household income, both of which had been battered over the last 7 years. As can be seen in Figure 1, occupancy is rising (vacancy is falling) nationally.

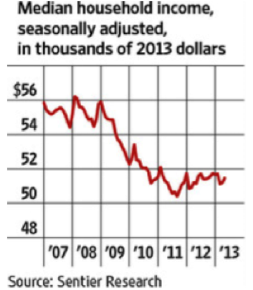

In Figure 2, we see that household income is just starting to tick up. Both measures are certainly positive and rents in some markets have begun to rise. That said, I passed on the recapitalization opportunity since we were at loggerheads on the pricing.

Since the last month’s Apartment Reporter, I wrote offers on 6 properties and was unsuccessful on every one of them. If the pricing doesn’t fit into my conservative model then I will pass and move-on. As there is risk in any purchase, my advice is to find the equation that works for you and stick to it. Remember to be cautious as you are competing with the emotions of others and you don’t want to later regret the property you bought today.

Deals are like streetcars, if you miss one, another will be coming along.