I am very lucky to be able to enjoy a career investing in and managing commercial real estate throughout the world. To boot, a wonderful company in WASH Laundry thought my writings were interesting enough that I have proudly been their Apartment Reporter for several years. I’ve chosen a career which I love and because of that I don’t really consider anything I do to be work.

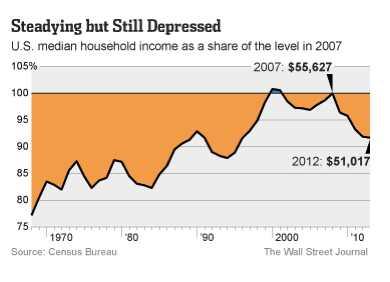

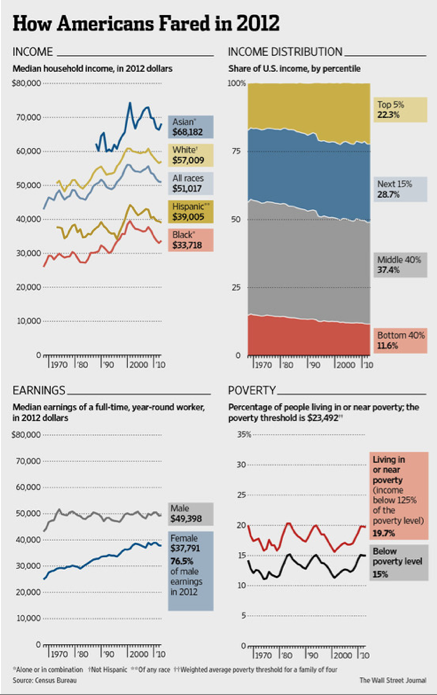

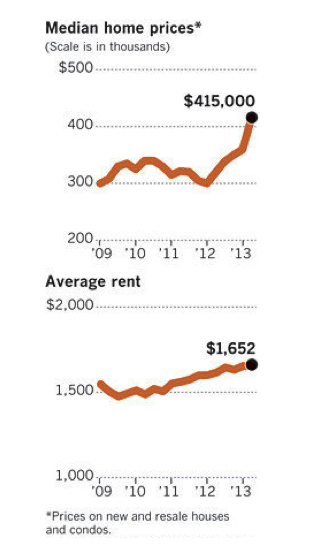

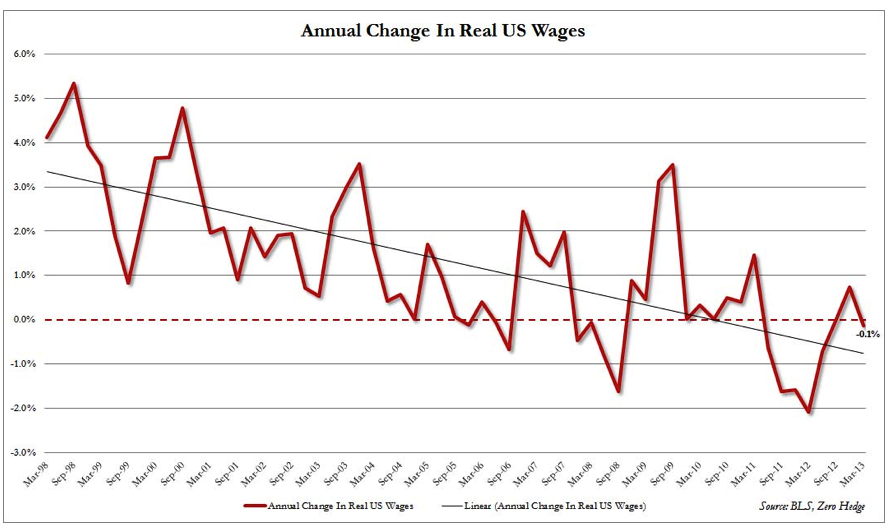

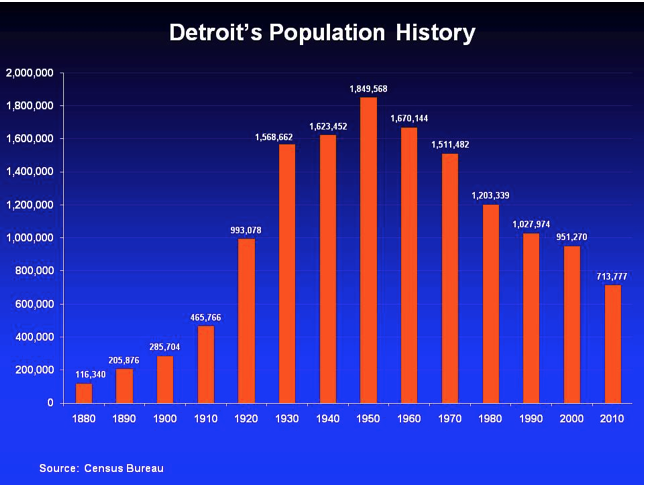

That said, because I care deeply about my reputation with investors, clients of our management and you dear readers, I stress the little things. In fact, this is my second draft for the December Apartment Reporter. The first was my perspective on the strong Chinese demand for California and Vancouver real estate, respectively and the effects on those markets. I also wanted to share why I believe we are in the midst a long-term economic shift in the United States whereby the population is going to be renters as opposed to owners.

And then over Thanksgiving Day, I took stock of 2013 and began my annual plotting of goals for the next year. Four wonderful people who were important in my life (3 of them were in their 50’s) passed away in the second half of 2013. As I thought about the state of the world and how best to own, manage and write about real estate, I needed to take a moment to reflect about having an attitude of gratitude.

While there are many ups and downs in owning and managing real estate, we do have an opportunity to make a difference in peoples’ lives through providing quality housing. Done right, we can epitomize the positive results of the “broken window theory” and begin and/or be part of the uplifting of a neighborhood which increases value for us and our neighbors.

I have found that I make the best decisions when I am in an appreciative mood. When people are anxious, angry or upset, the mind resonates those feelings through the thought process. For instance, while going through a list regarding residents on a list to being eviction proceedings, I was presented with a long term resident who lost her job because she wasn’t able to continue working while enduring chemotherapy. They had gone through their savings and had fallen a month behind in paying their rent. During that month, she was able to secure some steady work with flexible hours. I took a moment and thought about when my wife was in the midst of her successful fight against cancer and how grateful I was that she survived and is still healthy. When questioning the costs involved with replacing this many year resident, I was told that the building would need to offer a one month free rent incentive to the next inhabitant after replacing the carpet along with repainting the apartment. I asked the supervisor if we offered a one month special to the current resident (which would wipe away the delinquency), would she and her family sign a one year lease? The answer turned out to be yes and the story ended with a happy ending for our resident, the management team and the investors in the property. My positive energy was flowing from being sincerely happy about my own life and trying to think of the best possible outcome.

Over the years, I look back at my best decisions from asking my wife to marry me to making what turned out to be astute investments and they almost always involved a mindset of gratitude. When I draft an e-mail in response to something which has upset me, I now take the time to save the missive as a draft and will sleep on it before hitting “send.” If I don’t significantly change the e-mail then I’ll simply delete it as my frame of mind shapes my responses in a night and day fashion. It is amazing how different the world seems when your attitude goes from negative to positive.

As we close out 2013, I want to offer that I am thankful to be alive and am looking forward to a happy, healthy and prosperous 2014. I sincerely wish the same for you!